Refinancing mortgage loan during a part thirteen case of bankruptcy. Once you’ve produced about 12 payments for the Part thirteen trustee, you might be entitled to re-finance your existing home mortgage while in the the latest Part 13 package. If you are planning for the bringing cash out in the refinance, please note the bankruptcy proceeding trustee should be paid-in full towards bucks-away arises from the newest re-finance.

According to your guarantee status, you might still be able to remove even more cash out once settling brand new personal bankruptcy. You may want to over a speeds and you will identity deal during the personal bankruptcy.

Just like the a rate and you may name mortgage transaction need certainly to save some costs, usually, an excellent trustee is actually ready to sign-off on this exchange.

Gustan Cho Associates focus on enabling some one get a money-away re-finance during bankruptcy proceeding to order out the case of bankruptcy. Purchasing from the bankruptcy lets the citizen to get rid of brand new Part thirteen Bankruptcy proceeding early.

Bankruptcy Trustee Financial Approval

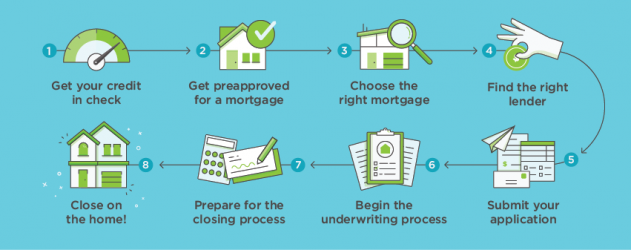

As part of the refinance techniques with a dynamic Chapter 13 bankruptcy, you need to discovered permission on the legal to get in into the brand new home loan. It’s very the same as a buy purchase.

I have helped of several website subscribers discharge the Part 13 personal bankruptcy very early with a funds-out refinance. Getting your own equity to function could possibly be the prevent of your own case of bankruptcy. Home prices are extremely large at present, so this might possibly be a good time to help you capitalize.

HUD Part thirteen Bankruptcy Guidance towards the FHA Fund

Standard requirements to have qualifying having a keen FHA loan having a section 13 Bankruptcy. five-hundred 579 credit score which have an effective ten% deposit. 580 credit score or even more, 3.5% down payment. No skipped percentage since processing bankruptcy proceeding into the trustee otherwise people points said on the credit report. Proof of you to-month reserves immediately following settlement costs and you will advance payment. Trustee permission to get in another home loan. Doing % you to to money ratio that have compensating affairs.

Virtual assistant Chapter 13 Case of bankruptcy Assistance on Va Fund

There is absolutely no lowest being qualified credit history on Virtual assistant funds. There is no downpayment necessary on Virtual assistant funds. At the least twelve with the-day repayments for the trustee. Zero overlooked commission while the filing personal Hartselle loan places bankruptcy with the trustee otherwise one activities reporting to the credit. Doing 55% DTI. 30 days off supplies

FHA and Virtual assistant Fund Throughout the Chapter thirteen Case of bankruptcy Guidance

How come too many loan providers give customers they must be totally released regarding a chapter 13 Case of bankruptcy for a few ages in advance of it meet the requirements? Extremely banking institutions dont manually underwrite mortgage transactions and get extra overlays related bankruptcies. Even though you is discharged regarding a part thirteen personal bankruptcy, however, 24 months haven’t elapsed, of a lot financial institutions you should never make it easier to.

Chapter 13 Bankruptcy proceeding Instructions Underwriting Mortgage Process Process

Please note, for everybody mortgage loans during a dynamic Part 13 Personal bankruptcy or below couple of years release out of your Chapter 13, your own document is downgraded to a manual underwrite to possess qualification motives. Many financial institutions do not be involved in manual underwriting. This can be something which sets Gustan Cho Lovers aside. Our company is experts in this new manual underwriting processes and therefore are here to answer questions. By hand underwriting an interest rate will get a somewhat stricter debt-to-income requisite.

Do HUD Wanted Reserves toward Instructions Underwriting?

Additionally, you will need a month away from reserves for the the bank after closing costs and you can down-payment. One month off supplies equals 30 days of your complete mortgage and you can commission, including prominent, attention, property taxes, homeowners insurance, and any property owners organization expenses. Don’t allow instructions underwriting frighten you, given that our team has arrived to obtain with the finish line rapidly and you will seamlessly. Chances are, you will understand that people is actually pros with mortgage lending close a section 13 Case of bankruptcy.