- Lower rates: While you are each other financing types enjoys equivalent rate of interest users, the fresh 15-year financing generally speaking also offers less price towards 31-seasons loan. The advances change over time, nevertheless the fifteen-year is typically regarding a 1 / 2 a per cent lower than the newest 30-season.

- Generate home equity faster: Over the years American residents usually disperse homes otherwise re-finance throughout the most of the 5 to help you 7 ages. Following High Credit crunch that it windows gone out to about 10 ages. If a person extends their mortgage repayments out over 29-decades they generate restricted security in their home in the early part of the mortgage. A person who takes care of a home in half enough time is not to make a payment that’s doubly higher. There are other costs regarding ownership including assets fees, insurance, fix & occasionally HOA charge. Such other expenditures renders doing step 1/3 of one’s normal month-to-month debts on the a thirty-12 months home loan, therefore paying off a designated amount of financial low interest personal loans Minnesota obligation in fifteen years in the place of thirty years may only show a 30% in order to thirty-five% huge overall payment per month.

- Higher life certainty: This new recovery since 2008 overall economy might have been bumpy, with broadening money inequality & an increased sense of monetary uncertainty than any monetary healing as the high market meltdown which implemented the fresh new 1929 stock market freeze. The rise of globalism, monopoly technology systems, distributed app having zero limited pricing & fake cleverness will most likely manage huge & lingering swells from architectural jobless. Few people know very well what the country might be as in 20 many years, therefore possibly it generally does not make sense to finance the largest get of the lives all over 3 decades. Those who generate equity quicker will have better certainty within their lives & will not be anywhere close to since concerned about what are the results once they clean out their job 23.5 years of today.

Drawbacks from fifteen-Season Mortgage brokers

- Increased payment per month get restrict your capacity to invest in highest coming back asset groups.

- Large repayments may make it harder so you can qualify for while the higher regarding a loan, pressuring one pick an inferior home otherwise you to definitely next away away from really works or perhaps in an alternative less prominent venue.

- If inflation surges having low-rate fixed loans which have a longer cycle makes you gain regarding pass on between rising cost of living and you can rates of interest.

Evaluating Full Mortgage Will cost you

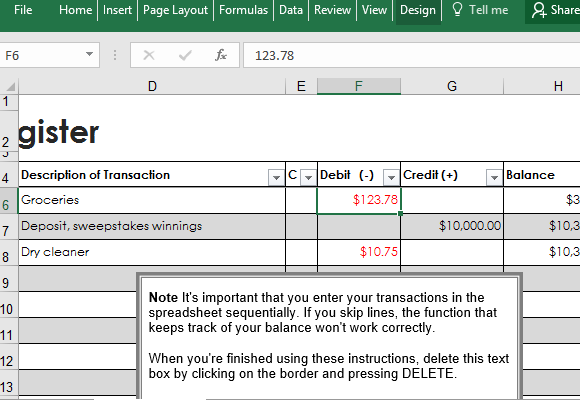

The next desk suggests loan balance into a great $2 hundred,000 home loan just after 5, ten , fifteen & 2 decades to possess loans for a passing fancy house.

Take note the above used rates of interest was related to your day of book, however, interest levels change every single day & depend each other on the private debtor together with greater markets standards.

The above calculations assume a great 20% down-payment into the a beneficial $250,000 household, people settlement costs repaid initial, 1% homeowner’s insurance policies & an annual property income tax of just one.42%.

Historical fifteen-Year & 30-Year Mortgage Rates

Another dining table listings historical mediocre yearly financial cost to have fifteen-seasons & 30-year mortgage loans. 2023 information is from the stop out-of November.

20% Advance payment

Home buyers who’ve a robust down-payment are typically considering straight down rates. Home owners exactly who lay below 20% down on a normal financing also have to pay money for property financial insurance (PMI) before loan harmony drops lower than 80% of house’s value. It insurance policy is rolling for the price of the new month-to-month domestic financing repayments & support insure the lending company could be paid-in the function away from a borrower default. Generally regarding the 35% from homebuyers whom explore funding put at the least 20% down.

Conforming Mortgage Restrictions

By 2024 the fresh new FHFA place the newest conforming financing limitation for solitary tool property over the continental All of us in order to $766,550, having a ceiling from 150% that amount during the places that average home values is actually highest. The limitation can be observe for a few, step three, and 4-device property $981,five hundred, $step 1,186,350, and you may $step one,474,eight hundred. The new limits try highest within the Alaska, The state, Guam, new U.S. Virgin Islands & almost every other highest-rates areas.