Your credit score is a reflection of your payment record with loans. Loan providers tend to become familiar with your credit history to see if youre an established debtor. The greater the get, the higher the loan words you could obtain.

Debt-to-Income

The debt-to-money ratio is actually a comparison of your own month-to-month money with your financial obligation. A higher DTI proportion form youre a good riskier borrower, very loan providers look into the finances to find the DTI.

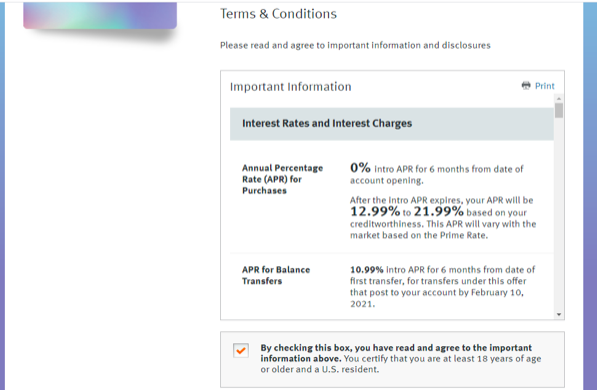

Rates

The rate is how lenders benefit towards that loan exchange. New debtor pays straight back the acquisition matter, nonetheless they in addition to pay money for focus.

As a whole, your own credit record make a difference the degree of interest your qualify for. Your regional housing market also can impact the home loan focus for the loan.

Such, a 30-season fixed-rates mortgage means that the rate cannot transform to own the size of the mortgage. At the same time, a varying-rate financial can change according to markets.

Down payment

A deposit ‘s the money you to definitely property visitors pays upfront to your price of a property. The dimensions of so it advance payment will change the total price of your financing. The larger the new down-payment, the low your own monthly payments was.

Personal Financial Insurance policies

Individual mortgage insurance policy is a tool loan providers used to defense certain of your own risks that include individuals exactly who do not want a keen enough down payment. It mortgage insurance rates assists protection the lender if your house customer misses money.

Settlement costs

Closing costs is a different sort of component that make a difference the complete pricing from a loan. In many cases, first-go out people are not aware closing fees as well as how they’re able to impact the transaction.

These can cost you tend to be attorney fees, loan manufacturing fees, lender fees, label search will set you back, one to month’s mortgage repayment, possessions transfer charge, although some. The costs from closing having property inside the Arizona usually cost 3-6% of total price off a house buy.

Serious homeowners should think about taking advantage of this type of information to evolve their odds of acquiring and you can remaining the basic household.

Homebuyer Degree Movement

Of a lot people enter the to shop for processes without undertaking adequate browse. It have a tendency to causes surprises and you may concerns within the transaction, resulting in extra worry if you don’t causing them to concern if they should buy a property.

There are several path choices for homebuyer guidance you could shot comprehend the ins and outs of the method.

Home loan Hand bad credit installment loans Nevada calculators

Possibly the way to determine what you really can afford would be to have fun with the brand new quantity yourself. A home loan calculator is an easy treatment for mess for the certain products working in loan will cost you, in the downpayment for the interest so you can taxation and you will insurance coverage.

Home buyers on Grand Canyon condition can also be gain a plus more than someone else because of the partnering with District Financing to secure their financing services undergo the to invest in process easily.

Sharing Financing Criteria

When you are a potential home buyer, your have likely of many questions relating to the kinds of financing apps available. For every single various other mortgage system provides more standards that can meet the requirements or disqualify your.

That have District Credit, you could potentially speak using all the info of the standards, including the restrict loan amount you can afford, minimal credit rating to possess a specific kind of financing, exactly how home earnings commonly affect your possibilities, while the down-payment and closing costs and this can be involved.

If you’re looking for a house with a price regarding 350K otherwise lower than, check out the step one% advance payment system to see if you qualify.