While contemplating taking on property upgrade opportunity from inside the the future, you’re curious whether you can online installment loans New Mexico find people a means to rescue on your large renovation. People want to money their property improvements by way of home improvement financing, as well as possibilities particularly household guarantee loans or HELOCs however they are home improvement loans tax deductible?

Learn more about Are Do-it-yourself Loans Tax deductible

In this post, we will tell you all you need to discover and that means you tends to make just the right decision for the handbag along with your home.

Was do-it-yourself money tax-deductible?

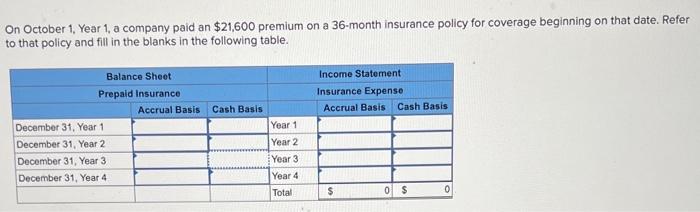

Do-it-yourself funds try taxation-deductible, although not precisely in the manner you might think. With respect to the Internal revenue service, you might subtract one attention you pay towards do it yourself funds provided one can use them in order to “buy, build, otherwise considerably boost a great taxpayer’s house.” There are numerous caveats to that, hence we’re going to wade alot more when you look at the-breadth regarding the lower than, but also for today, all you have to discover is that very do-it-yourself finance try taxation-deductible provided the home upgrade was “substantial” and this leads to a rise in the general house really worth. Put differently, first solutions dont count. In addition to that, however, interest repaid home improvement funds can only become tax-deductible if the home accustomed secure the financing (the house made use of given that equity) is similar one to where in actuality the renovations are complete. For almost all home owners, our home financial appeal deduction is the starting point in enabling a bit of cash return. Your house financial notice deduction deducts attention out of an excellent priple out-of a vacation mortgage are a house equity loan a common supply of do it yourself financing for most people. Now, on the best way to capture which mortgage loan focus deduction, the debt must be protected by the an experienced family (their collateral). A personal loan for example certain types of unsecured loans do not be eligible for income tax deduction intentions. Once again, our home has to be your main or next family third or last home do not count. It can be a home condominium, house trailer, cellular household, cooperative, ship, or other brand of equivalent assets so long as they matches the next conditions: You employ the home for over 2 weeks per year (or more than ten% of the full amount of days in that the residence is used because the a rental) It’s got separate sleep, preparing, and you may toilet facilities You could potentially usually subtract financial insurance premiums, mortgage desire, and you can household guarantee mortgage attract out of your fees. Constantly, you could potentially subtract a full level of your house financial desire but that it relies on the latest go out it had been removed and you may how much cash it is having (as much as $375,000 getting a single individual and you may $750,000 to own a married couple submitting together until the borrowed funds is actually an older one to).

Just what home improvements is tax deductible?

Having a house improvement as tax-allowable, it should be a thing that contributes worth to your residence. A servicing or something which you do in order to keep your family during the a beneficial working acquisition is not something which are deducted. Substitution a cracked windows wouldn’t be felt a taxation-deductible expenses however, replacement a cracked screen that have Times Star rated windows create. Income tax write-offs can also happen inside a property office, rental assets, or qualifying scientific costs.

What is actually considered a substantial do-it-yourself?

Once again, brand new home improvements need certainly to “considerably alter your domestic” or perhaps experienced “good-sized home improvements.” So it wasn’t constantly the scenario. Prior to the Taxation Slices and you will Jobs Work from 2017, each home guarantee loan is actually tax-deductible, regardless of how these were being used to possess. Today, when you’re using the loan to have something not related to your house eg a vacation or to pay-off personal credit card debt it will not be eligible for any sort of income tax deduction. If you utilize your house improve mortgage to invest in home repairs, do not anticipate to score good deduction, possibly. Including, such things as painting and you may gutter clean you should never amount except if he could be quicker areas of a bigger project. For instance, if you are using a home update mortgage so you’re able to remodel any home and it also needs to be repainted in the bottom, new color is covered with the rest of the fresh project and become utilized due to the fact a tax-deductible costs. Examples of income tax-deductible “substantial” home improvements are: Adding the insulation Strengthening a connection Creating a unique rooftop (repairing an old you to definitely usually doesn’t matter) Strengthening a patio Carrying out major landscape work Setting up alot more opportunity-productive equipment, resources, and you may gizmos Actually medical expenses which are not protected by your health insurance carrier can be amount. Like, including ramps, enlarging doors having wheelchairs, otherwise installing handrails about bathroom can also be amount with the aim out of tax deductions.