Become entitled to a beneficial Va financing once the a nationwide Shield or Put aside member, you must fulfill particular standards. Including which have finished half dozen numerous years of service or having been entitled to help you effective obligations for around 90 straight weeks while in the wartime otherwise 181 successive weeks through the peacetime. Additionally, you must have an enthusiastic honorable launch or even be currently offering to qualify. Because of the consulting with an effective Virtual assistant loan specialist, they may be able give you personally designed suggestions considering your private issues.

Federal Guard members may have usage of stretched Va home loan eligibility due to recent legislative alter. The latest National Security Authorization Work (NDAA) for Fiscal Season 2020 stretched Va financing eligibility without a doubt National Protect users, letting them be eligible for Virtual assistant finance with fewer ages out of solution than in the past requisite. These transform assist a great deal more Federal Shield members realize their homeownership fantasies due to Va fund.

Va Loan Credit Requirements

Like most other financing program, Virtual assistant money has actually borrowing criteria that must be came across to possess approval. But not, the fresh Va mortgage system can be more flexible than conventional financing with regards to fico scores. Because there is no specific minimum credit rating specifications, loan providers might have their particular borrowing standards to make sure the cover. It is advisable to look after a https://paydayloansconnecticut.com/daniels-farm/ beneficial credit history and really works for the boosting your credit score to compliment your odds of securing a good Virtual assistant loan.

Va Mortgage Earnings Requirements

Virtual assistant money enjoys income conditions to make certain borrowers have the mode to settle the loan. Such requirements are different depending on situations such family relations proportions, area, or any other bills. Lenders normally glance at the debt-to-earnings ratio to determine your ability to effectively perform mortgage repayments. Delivering specific money documentation and working which have good Virtual assistant loan specialist, you are able so you’re able to browse the funds criteria more effectively.

Va Loans Advancing years Activities

Having National Shield and Put aside participants, old age things play a life threatening character inside choosing Va mortgage qualification. Advancing years items was received predicated on services and certainly will have demostrated the length and characteristics of one’s military service. These activities are considered combined with most other qualification criteria whenever examining your own certification for a great Virtual assistant mortgage.

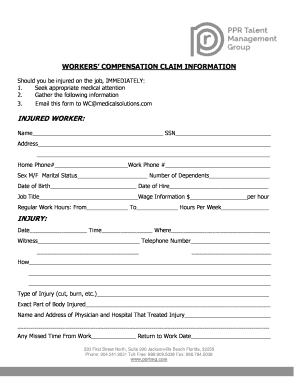

Va Financing Files to possess Guard & Reserve players

- Certificate out of Qualification (COE): This new COE demonstrates you are eligible to good Virtual assistant Financing just like the good latest or previous solution representative. Shield and you may Reserve professionals can sometimes you would like a copy of their Statement of Service, which is finalized of the, or from the direction off, the newest adjutant, staff manager, otherwise frontrunner of one’s product or even more head office he’s connected to help you.

- DD Means 214: You’ll need a copy of your own DD Mode 214 once you have done their term out-of services. That it file is among the most complete checklist from army services, such as the profile regarding services and you will cause of separation.

- NGB Form twenty-two: The fresh new National Shield comparable to the new DD Form 214. This form traces their service on Federal Protect.

- Evidence of Earnings: Spend stubs, W-2s, or tax returns might possibly be necessary to prove your income. For those who found money from other supplies, such old age otherwise leasing money, you will need to provide records of these also.

- Lender Comments: Needed recent lender comments to confirm your debts.

- Credit report: Loan providers often eliminate your credit score. Since the Va does not put the absolute minimum credit history having fund, many loan providers will demand the absolute minimum get.

- Statement off Solution: When you are currently serving, an announcement regarding provider closed by your leader otherwise a selected user, claiming their title, Societal Safeguards count, day off beginning, admission date on the effective duty otherwise to your Shield otherwise Reserve, duration of missing day, together with label of your demand offering the recommendations.