loan places Wilsonville

Month-to-month Mortgage payment

The mortgage repayment to have good $222k house is $step one,480. This is predicated on a good 5% interest rate and you can an excellent ten% downpayment ($22k). This may involve projected assets taxes, hazard insurance policies, and you may home loan insurance premiums.

Income Necessary for an effective 200k Financial

You really need to create $74,006 annually to cover the good 200k mortgage. I base money you want into the an excellent 200k mortgage towards a repayment that’s 24% of month-to-month earnings. For you personally, your own month-to-month earnings are going to be throughout the $6,157.

You may be much more conservative otherwise an excellent a bit more aggressive. You can easily change this within exactly how much home should i manage calculator.

Take the Test

Use this enjoyable test to determine how much house I can afford. It takes only a few minutes and you’ll be in a position to feedback a personalized review towards the bottom.

We’ll make sure you aren’t overextending your allowance. You will also possess a smooth matter in your bank account after you get your home.

Don’t Overextend Your financial allowance

Banking institutions and you will real estate agents earn more money once you pick an even more pricey household. In most cases, finance companies commonly pre-accept you for the most you could possibly manage. Out of the gate, upfront traveling land, your finances was prolonged on the maximum.

It’s important to make certain you was more comfortable with your own payment per month and also the amount of cash you should have kept within the your finances once you buy your home.

Contrast Mortgage Pricing

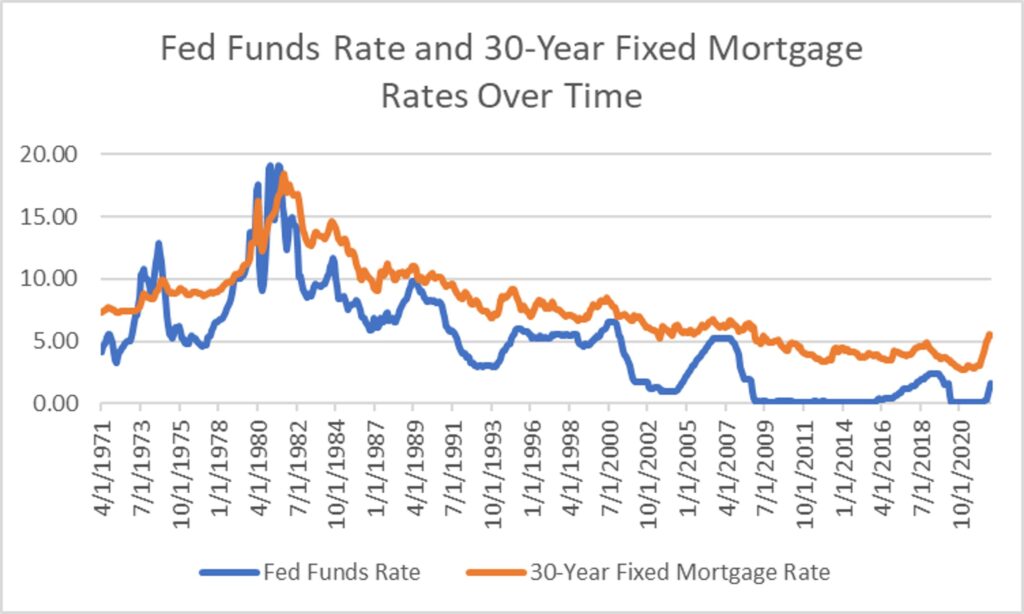

Make sure you contrast financial prices before you apply having a great financial loanparing 3 lenders could save you several thousand dollars within the a few several years of the financial. You could potentially examine financial costs to the Plan

You can observe most recent home loan rates or observe how home loan pricing now possess trended more than recent years into Plan. We display every day financial cost, fashion, and you can discount circumstances having fifteen year and you can 30 seasons financial points.

- Your credit rating is an essential part of the financial processes. For those who have a top credit history, you have a much better danger of delivering an excellent approved. Loan providers tend to be more safe giving you home financing payment you to are a bigger percentage of the monthly earnings.

- Homeowners relationship costs (HOA costs) can affect your home to get stamina. If you choose a home that highest organization charge, this means you’ll need to choose a lowered priced the place to find so you can reduce the principal and you can notice payment enough to render room into HOA fees.

- Your most other obligations payments can impact your residence finances. For those who have lowest (otherwise no) most other financing costs you can afford going a small higher on your own mortgage payment. If you have large monthly installments to many other financing eg auto money, student loans, or playing cards, you will have to back down your own month-to-month mortgage repayment a little to ensure that you feel the finances to expend all debts.

Not so long ago, you must build a great 20% downpayment to cover a home. Today, there are many mortgage items that allow you to make an excellent much smaller downpayment. Here you will find the down payment requirements having common financial facts.

- Old-fashioned funds need an excellent 5% down payment. Particular very first time homebuyer programs create step three% off costs. A couple advice are House Ready and you may Household Possible.

- FHA finance need a great step 3.5% down-payment. To qualify for a keen FHA loan, the property you are to order should be much of your house.

- Va financing wanted good 0% deposit. Productive and you may resigned army employees are eligible for an effective Va mortgage.

- USDA financing need a great 0% downpayment. Talking about mortgage loans that are offered from inside the rural aspects of the nation.

Do you know the methods to purchasing property?

- Mess around with many financial hand calculators. Start getting comfortable with every expenses associated with to shop for an excellent home. Most people are amazed after they see how much more possessions taxation and you may home insurance adds to the commission each month.

- Look at your credit rating. Many banking institutions tend to now assist you your credit score for free. You are able to explore a software such borrowing karma.