Whenever financing servicer rejects an ask http://www.paydayloanalabama.com/perdido-beach for that loan amendment or other losses minimization choice based on “investor direction,” the new servicer could well be dealing with the latest PSA. The newest PSA more than likely cautiously means the mortgage servicer’s duties to possess meeting costs, approaching losses mitigation (for instance the expert to modify funds), and you will foreclosure.

If you think you used to be wrongfully refused a loss of profits mitigation alternative, pose a question to your foreclosure attorneys to locate a duplicate of PSA and remark they of these assistance. The lawyer should also learn how to see financing repair telecommunications logs and you may fee records. This type of data include information about how and if new servicer reviewed your losses mitigation software.

In case your securitization are public, brand new PSA will be registered to the Securities and Change Commission (SEC). You might constantly come across a copy into the EDGAR (Digital Data gathering, Data, and Retrieval) on .

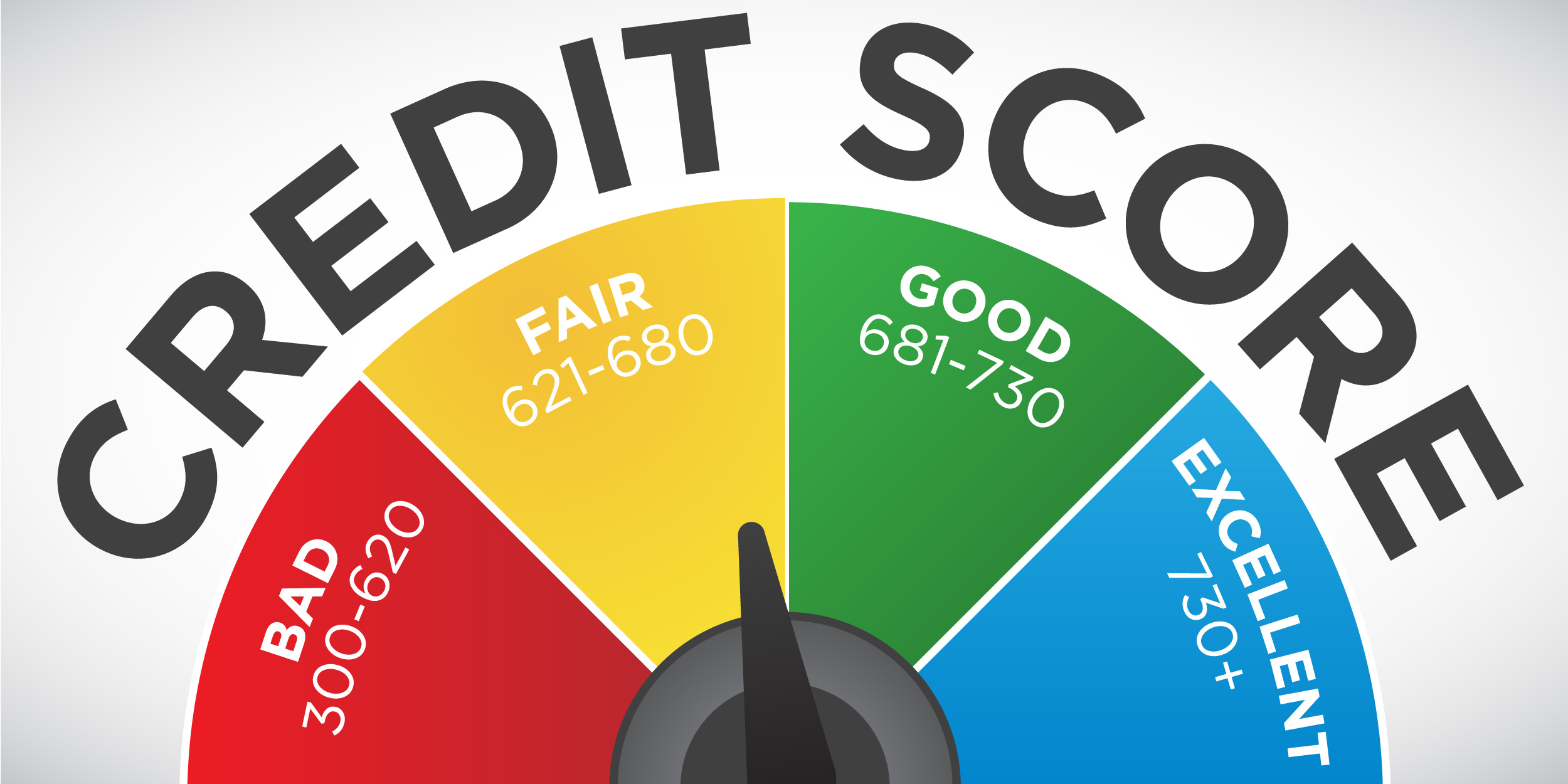

Standardized underwriting criteria for several types of financing let companies designate analysis

Once again, the brand new foreclosures might possibly be submitted in the title of your own securitized believe. Eg, state you might be up against an official foreclosures, together with plaintiff on the suit is actually “Ameriquest Home loan Bonds Inc. Asset-Supported Solution-Owing to Licenses, Collection 2004-R10.” The easiest way to get the PSA will be to take the following the steps:

- Basic, just click “Business Filings” towards SEC website.

- Second, get into “Ameriquest Financial Bonds Inc. Asset-Backed Solution-Thanks to Licenses, Show 2004-R10” regarding the “Company Term” box. (Or you might need to shorten they so you can “Ameriquest Mortgage Ties” or something like that just like score a listing of solutions.)

- Then, click the CIK amount (the quantity new SEC spends to understand an excellent organization’s filings) near the trust name. That it introduces a listing of the brand new data registered toward SEC which can be of that it trust. New PSA would-be a stand-alone file or integrated as part of a different file, including the “Prospectus.”

But not, only a few trusts is listed towards the SEC, so you might not be able to select the PSA linked to the loan this way. In that case, you might try to make a professional created demand to locate a great copy of your PSA. Or their attorney may consult a duplicate of your own PSA since the section of development for folks who strive the fresh property foreclosure in legal.

You may find your foreclosing party’s term boasts the language “pass-using licenses.” Mortgage-backed securities are usually arranged in that way. A share of one’s money (the borrowers’ costs of prominent and you will interest on the fund one to make up the safety) passes through an intermediary, including a good servicer, and visits this new traders.

PSAs have become complicated and certainly will feel a huge selection of pages long. In the event the loan might have been securitized and you are clearly against a foreclosures otherwise was basically denied a loan modification, communicate with a lawyer locate here is how the latest PSA might connect with your circumstances.

As to the reasons Mortgage People Essentially Including Mortgage-Backed Securities

That have securitization, mortgage dealers normally most readily useful see the rates and you can chance of the capital as the accepted credit score businesses identify various tranches in respect on their cousin risks. (Mortgage-supported bonds are usually created from inside the numerous “tranches” in line with the riskiness of the resource. A “tranche” was a fraction of an effective pooled distinct bonds that’s categorized by the exposure or any other properties so as that its valuable to different people.)

High-rated tranches are made up regarding shorter-risky funds. Low-ranked tranches, which are often comprised of subprime loans, hold higher risk.

Personal mortgage loans, at exactly the same time, are burdensome for investors understand and price. And you can, when investing financial-supported ties, a trader are protected about danger of an individual mortgage standard.